what to do if tax return is rejected

Fixing an IRS Rejected E-File. Misspell your name hey it can happen to the best of us The IRS will.

If Irs Rejects Your Form 2290 Here Is How You Correct Them Rejection Irs Forms Correction

If your return is rejected due to a typo or a misspelling you can fix your return and then re-submit it to the IRS.

. Heres a list of steps you can take if the IRS initially rejects your return to ensure that it will be accepted when you resubmit it. Using all 3 will keep your identity and data safer. You will need to create your own petition that includes the facts law argument and your position for higher amounts.

Choose Overview at the top of the screen in your HR Block Online product. To your TurboTax account. Upon review of my IRS transcript I found that the AGI per computer was different from the AGI in my TurboTax submission.

A spouse has already e-filed a return for the said year or someone has stolen the. You have to use IRS Form 12203 for amounts of less than 25000. You may end up having your tax return rejected if you.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. Go to Check Status or Next Steps. Once youve fixed the error select File in the left-hand menu and follow the instructions to either e-file or file by mail.

One number out of place can make your Social Security number the same as another filers and get your tax return rejected. The IRS generally corrects mathematical errors without denying a return. Once youve fixed the error select File in the left menu and.

If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return. When a tax return is e-filed and is rejected it is often due to taxpayer information that has been entered incorrectly and does not match what the Internal Revenue Service IRS is expecting. Tax returns are rejected because a name or number in the tax return does not match the information contained in the IRS databases or the Social Security Administration.

Enter the wrong date of birth. Enter the wrong Social Security number. A tax return rejected code R0000-902-01 means your Social Security Number has been used in that current year to e-file a tax return.

You may end up having your tax return rejected if you. 1 267-941-1000 for international callers or overseas taxpayers Option 1 4 1 to speak to an IRS Agent specifically about your case. If we have also received rejections that your tax return has the same information as a previously accepted.

Only the IRS will calculate thisTurboTax will not calculate it. You can viewprint your return from within your account by logging into your account and selecting the SummaryPrint tab from the navigation bar. Then repeat the Filing step to resubmit your return.

Select Fix my return to see your rejection code and explanation. 2020 Federal Tax Return Rejected. The rejection code IND-510 means your Tax Identification Number has been used by someone else to e-file a tax return.

Enter the wrong date of birth. If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you. When you mail a tax return you need to attach any documents showing tax withheld such as your W-2s or any 1099s.

After youve updated your return you can. If you do not see an option for View Return select the Show Details dropdown. Youll have to file a petition about your rejected tax return with the IRS Office of Appeals if you dont agree with the IRS decision.

Select Fix my return to see your reject code and explanation. Even electronic filers must electronically sign their tax return using their tax return software. Choose Details about the Rejection and Fix Issues to correct any problems.

You can even solve the problem online and. Next select View Return to view print or save a PDF copy of your return. Select Fix it now and follow the instructions to update the info causing the reject.

For the SSA you may reach them thru this number 1-800-772-1213. We recommend this IRS phone number. Select Fix it now and follow the instructions to update the info causing the reject.

Rather when you first submit your return a computer will verify if all of your basic identifying information such as your Social Security number is correct. You may want to review the IRSs guide to identity theft which includes recommended procedures and warning signs of identity theft and monitor your credit reports going. This could mean two things.

If you owe tax due then file and pay the amount due as shown on the Form 1040 but expect a bill later from the IRS for the penalty and interest you will owe. You must sign your tax return to be accepted by the IRS. Misspell your name hey it can happen to the best of us The IRS will.

Name your spouses name if youre jointly filing or names of employers business partners or spouses. Failure to sign results in a rejection. Your tax return might get rejected if you incorrectly entered your.

IND-031-04 - The primary taxpayers AGI or Self-select PIN from last year does not match IRS records. To view print or save your PDF. Enter the wrong Social Security number.

I updated the AGI to reflect the per computer value and resubmitted but the return was. Your signature is your affirmation that all the information on the tax return is true and correct to the best of your knowledge. Spelling and typo errors can be quick and easy to correct.

If your Social Security Number name or a number from your W-2 was incorrectly typed into your return and caused your return to be rejected review and correct your personal information entries in Basic Information of the Federal QA. Sign in to TurboTax.

How Do I Find Out If My Tax Return Is Accepted E File Com

You Could Be Filing A Faulty Tax Return Here S How To Avoid Getting It Rejected Credit Card App Tax Return Rejection

Eidl Rejected Unable To Verify Information Cost Of Goods Sold Tax Return Business Owner

What To Do When Your Income Tax Return Itr12 Is Rejected By Sars On Efiling Due To A Directive Youtube

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Audited Books Cannot Be Rejected In Such A Casual Manner Ad Hoc Disallowances Are Arbitrary And Cannot Be Upheld Tax Refund Rejection Audit

Know What Is Online Income Tax Return File Income Tax File Income Tax Income Tax Return

One Reason Your E File Tax Return Was Rejected The Washington Post

Do You Know The Reason Behind Rejection Of Gst Registration Follow Gstinsights For Gst Rel Goods And Service Tax Goods And Services Government Organisation

Irs Audit Letter Irs Lettering 2017 Printable

What Happens If Your Bank Rejected Tax Refund Mybanktracker

Irs E File Rejection Grace Period H R Block

What Happens If I Have My Tax Return Rejected The Motley Fool

13 Common Tax Mistakes You Might Be Making Middle Class Dad Llc Taxes Tax Tax Refund

How To Handle A Tax Return Rejected By The Irs

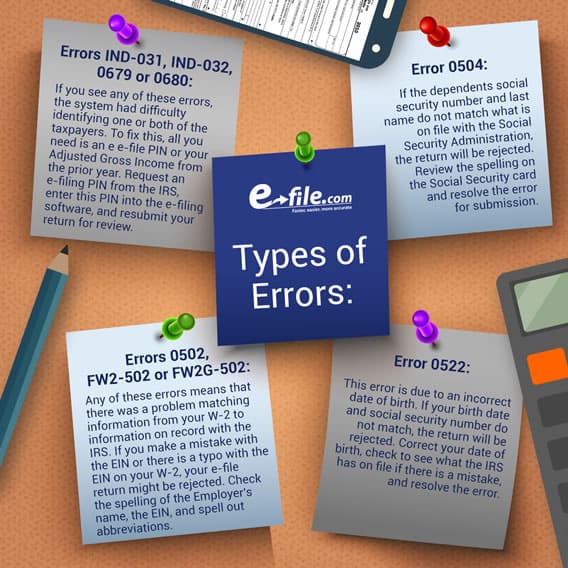

Possible Rejection Reasons When E Filing Taxes E File Com

What To Do When Your Tax Return Is Rejected Credit Karma Tax

How Do I Fix A Rejected Return Turbotax Support Video Youtube