price to cash flow from assets formula

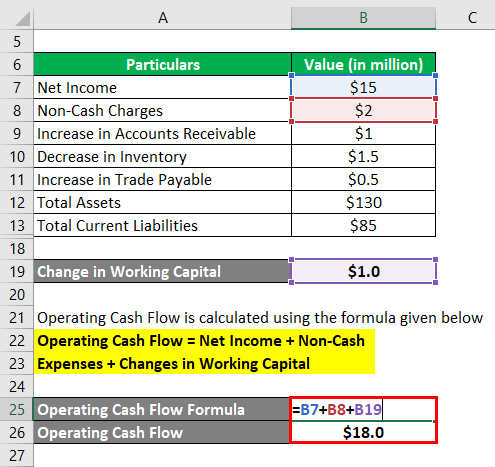

It is the net amount of cash and cash-equivalents moving into and out of a business. Operating cash flow is equal to revenues minus costs excluding depreciation and interest.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

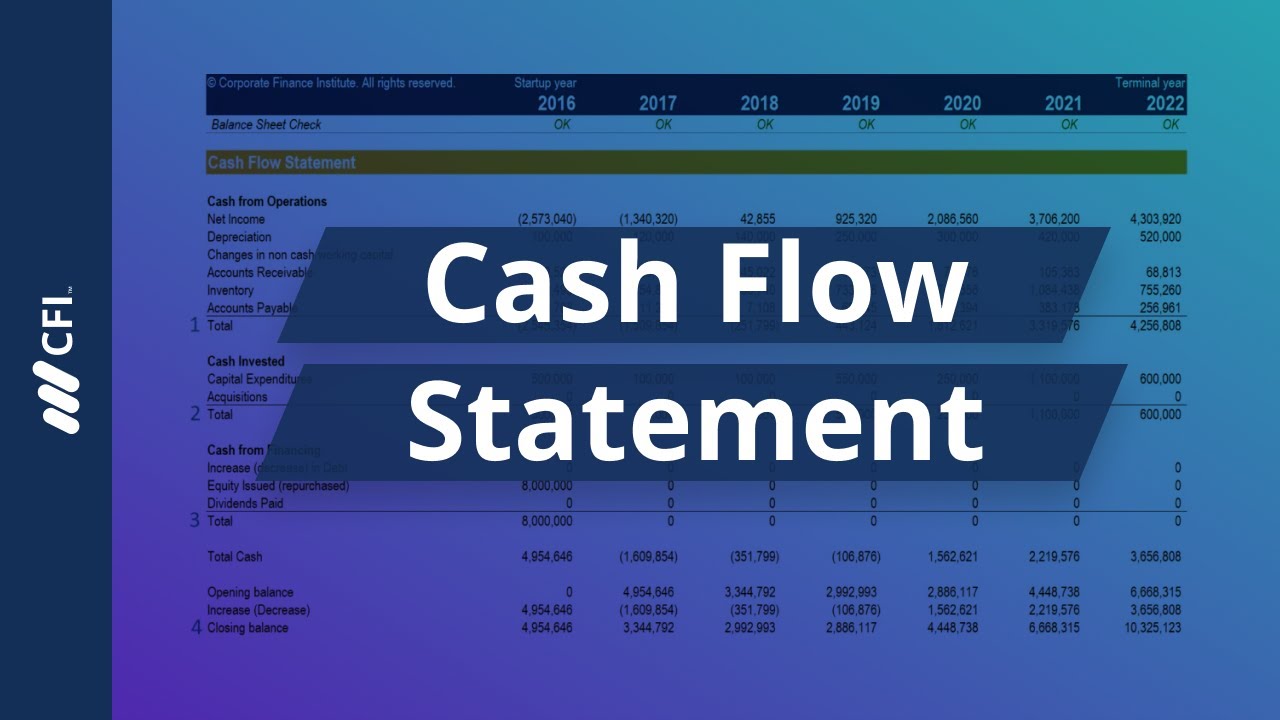

Cash Flow Statement Analyzing Cash Flow From Investing Activities

To calculate net cash flow from assets.

. Depreciation expense is excluded because it does not represent an actual cash flow. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000. This figure is also sometimes compared to Free Cash Flow to Equity or Free Cash Flow to the Firm see a comparison of cash flow types.

Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital Cash Flow. If you want to calculate net cash flow from these entries use the following formula. Current Stock Price Cash Flow per Share 50 15 333 In case of Frost we need to estimate operating cash flows and then work out PCF as follows.

Price to Cash Flow Share Price or Market Cap Operating Cash Flow per share or Operating Cash Flow The PCF ratio equation can also be calculated using the market cap like this. PricetoCashFlowRatioSharePriceOperatingCashFlowperSharetextPrice to Cash Flow RatiofractextShare PricetextOperating Cash Flow per SharePricetoCashFlowRatioOperatingCashFlowperShareSharePrice See more. Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance.

This results in the following cash flow from assets calculation. CFFA 20000 -8000 -2000 10000 This calculation of. Heres how this formula would.

24000 -10000 2000 16000. Your answer is 10 which means that investors. The discounted cash flow.

Here we provide you with the cash flow from assets formula. FCF Earnings Before Interest Tax x 1 Tax Rate Depreciation Amortization Change in Net Working Capital Capital. 50 5 10.

Now you must find the price-to-cash flow ratio. You divide the share price by the operating cash flow per share. Based on the given values the companys Operating Cash Flow Per Share is calculated at 3.

Once they have these three numbers Johnson Paper Company can calculate their cash flow from assets. Free cash flows are calculated as follows. FCF Cash from.

Add the three amounts to determine the cash flow from assets. Net cash flow Δ equity Δ financial debt Δ payables Δ provisions Δ fixed assets Δ. Assume EV Company a metal fabricator has an operating cash flow of 300 million within a year a per-share price of 15 and 100 million shares outstanding.

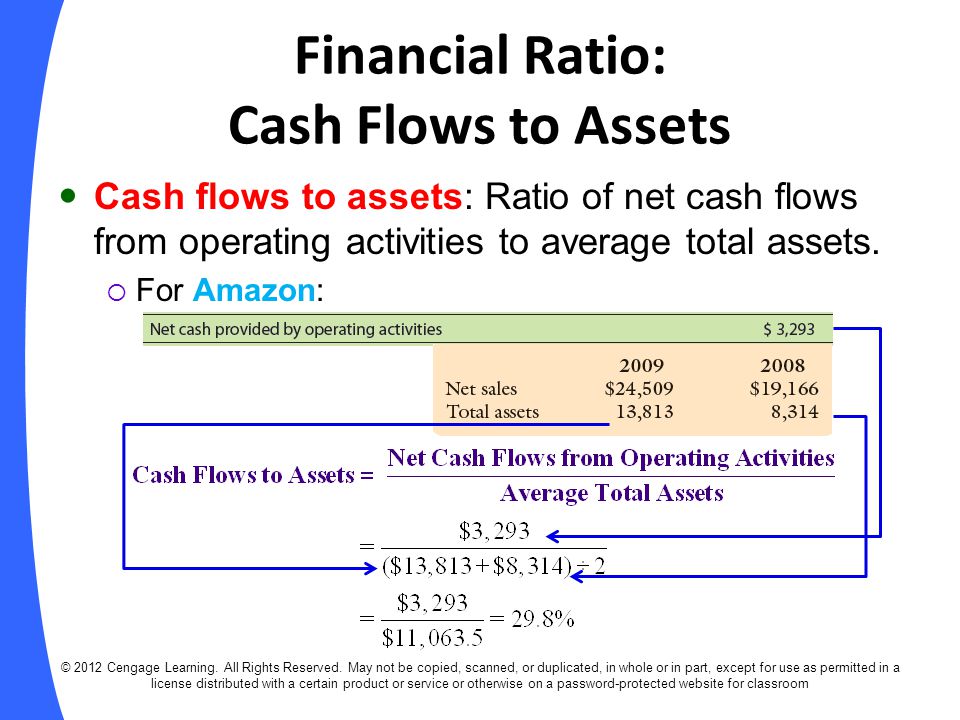

The Price to Cash Flow ratio formula is calculated by dividing the share price by the operating cash flow per share. Cash flow from assets formula cash flow from operation net working capital change in fixed assets. Price to Cash Flow Ratio Example.

Operating Cash Flow Formula Calculation With Examples

Price To Cash Flow Ratio Formula Example Analysis Guide Definition

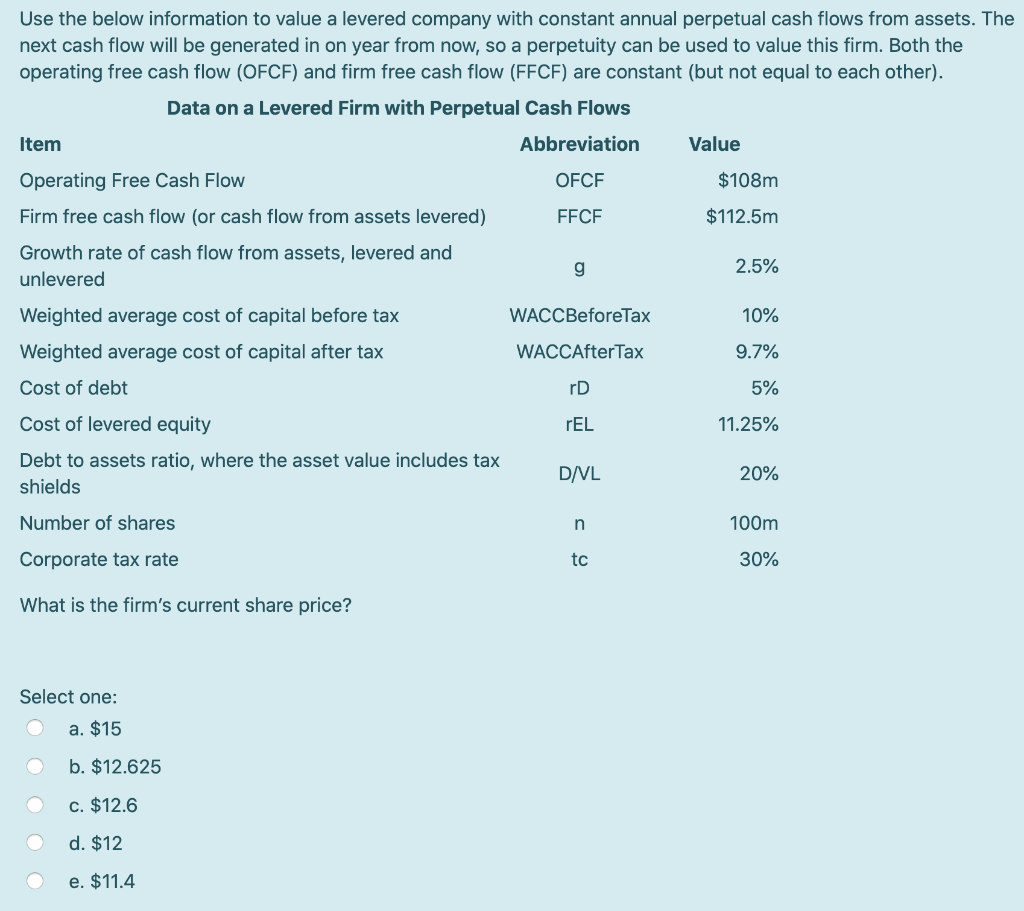

Solved Use The Below Information To Value A Levered Company Chegg Com

Cash Flow From Operations Cfo Financial Edge

What Is Net Cash Flow And How Do You Calculate It

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Return On Investment Examples With Excel Template

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Net Cash Flow An Overview Sciencedirect Topics

Chapter 12 The Statement Of Cash Flows Ppt Download

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

Cash Flow Analysis Basics Benefits And How To Do It Netsuite

Net Cash Flow An Overview Sciencedirect Topics

Profit And Cash Flow What Is The Difference Business Tutor2u

How To Calculate Total Assets Definition Examples

How To Calculate The Intrinsic Value Of A Stock The Motley Fool